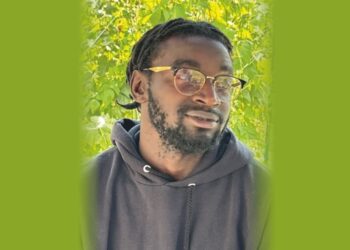

Meet Ceaser Siwale, a visionary leader with an illustrious career spanning 25 years in African financial markets and over two decades in investment banking. As the Founder and Executive Chairman of Pangaea Holdings Limited (“Pangaea”) and the Chief Executive Officer of Pangaea Securities Limited, Ceaser has been at the forefront of driving transformative change and executing landmark transactions across the SADC region.

Under Ceaser’s leadership, Pangaea has raised over US$3.0 billion in client capital, solidifying its position as a trusted partner in the financial industry. His expertise and leadership style have earned him recognition from esteemed entities such as The Banker, Euromoney, Forbes, CNBC Africa, and more.

Beyond his role in financial markets, Ceaser is also an active investor with a keen entrepreneurial edge, particularly in the FMCG, media and real estate sectors. Between 2003 and 2016, he was instrumental in bringing the first digit 3D cinemas to Zambia under a homegrown brand, development of the second shopping mall in Zambia and international brands such as Mugg n Bean and Pizza Hut into Zambia, Zimbabwe and Mozambique. In 2017, he opened an office in South Africa as a hub to execute regional transactions and draw South African capital into the region. In 2021, through Pangaea Holdings, he invested in Zambia’s fastest-growing supply chain financing business that leveraged off his relationship with the regional corporate for reverse factoring and ultimately supporting SMEs. In 2023, in partnership with a German family office, he co-founded The Critical Minerals Fund, intended to fund the exploration of critical minerals across Africa. This journey demonstrates his commitment to driving innovation and sustainable growth across the industries that he invests in.

As an executive director of The Critical Minerals Fund, Ceaser dedicates approximately 40% of his time to operationalizing the Fund, leveraging his vast experience and strategic acumen to drive its success.

Additionally, he holds directorships and represents shareholdings in Pangaea Securities Limited, Privida Zambia Limited, Lusaka Securities Exchange PLC, Pangaea Advisory Group (Pty) Ltd and Pangaea ADD Capital Limited.

Throughout his tenure as a leader, Ceaser has been a staunch advocate for supporting regional SMEs and implementing business-friendly policies to foster growth and development. His unwavering dedication to championing entrepreneurship and driving positive change underscores his commitment to building a vibrant and prosperous future for the African continent.

Below are highlights of the interview:

Tell us about the sub-brands.

Pangaea Holdings Limited, established in Zambia, has positioned itself as a cornerstone of socio-economic growth in the SADC region through investments and financial services. We are committed to empowering our communities and working with marginalised groups to promote sustainable development and pioneer inclusiveness across various sectors of the regional economy. Our dedication to innovation, community upliftment, inclusiveness and ethical practices drives us to integrate financial success with transformative social impact and make a meaningful difference across the SADC region.

The Critical Minerals Fund is still at a conceptual stage and is not an incorporated entity but is currently held under Pangaea Holdings Limited. Our German partners, CHB Investment Holding GmbH, aim to strategically focus on investing in African entities at advanced stages of mining exploration or those approaching the production of battery minerals. We have an important role in financing Africans to participate in developing new mines, which will be critical to positioning SADC on the global stage as a significant player in the energy transition process.

Pangaea Securities Limited is licensed by the Zambian Securities and Exchange Commission, registered with the London Stock Exchange and is the largest shareholder in the Lusaka Securities Exchange. The firm specialises in providing brokerage and trading services, financial advisory services, and mergers & acquisition leadership. Pangaea is dedicated to creating value for its clients through innovative financial solutions, leveraging in-depth market knowledge and expertise to support corporations, SMEs, and individual investors in achieving their financial and strategic objectives.

Pangaea ADD Capital Limited is an innovative supply chain finance specialist. The core offerings are invoice discounting and order finance for pre-vetted off-takers and anchor corporates. In addition, the company offers financial consultancy and technical assistance to existing clients. The core strategy is to focus on small and medium enterprises with a broader view of triggering opportunities that meet sustainable development goals.

https://www.pangaeaaddcapital.co.zm

Privida Zambia Limited is a partnership with Privida Energy, a leading West African company providing energy solutions to rural communities that are off-grid. The Zambian partnership is intended to replicate this business model by providing a world-class solution to the energy challenges that these communities face. The partnership is led by a team of seasoned professionals and partners keen to create an integrated energy of choice driven by global best practices, consistent growth, and efficiency whilst offering sustainable energy solutions by working with the leaders in the communities where we seek solutions.

Pangaea Advisory Group (Pty) Limited is a South Africa-based advisory firm focusing on large-scale infrastructure and social housing projects in the SADC region. The operations are in partnership with a leading regional infrastructure consultancy firm. The team brings a wealth of knowledge in asset management, mining, and energy transition, and the activities complement those of the other sub-brands.

http://www.pag.pangaea.co.zm

How did you initially get involved in the financial sector, and what motivated you to pursue a career in this field?

The financial sector is like a calling for me. We have never positioned ourselves as purely an investment bank, although those skills and expertise are essential to our diverse client base. However, our primary focus is to provide those in our communities access to structured finance that the traditional banks need help to fulfil or understand how to localise the finance. I was blessed to have grown up on 3 different continents and interacted with colleagues from over 60 countries. When I reflect back today, the experiences I have gained from a young age, in these diverse locations, and into my professional career have positively contributed to this calling and purpose I believe I have to answer to. Today, Africa, particularly SADC, is central to the digitally integrated world that we are all pursuing.

How do you foster a culture of innovation and adaptability within your organisation, considering the rapidly changing landscape of the business industry?

This is a great question at the core of our values. We are known for being innovative, first-movers disruptors, but inclusivity, equality and the progression of our people across our communities are also our primary focus. Our mission is to be at the forefront of development, nurturing an environment where investments and cultural values mutually reinforce sustainable progress. Cultivating financial resilience and innovation across the SADC region, ensuring each economic stride contributes to a globally resonant African narrative and cultural heritage. We strongly believe empowerment and prosperity must be achieved through cultural insight, recognition, and respect.

How do you prioritise customer satisfaction and ensure the sub-brands provide exceptional service to their clients?

Unlike in the West, many African businesses are predominately family-owned and not by institutional investors. They are usually first movers in their respective sectors, so our interactions are generally highly personal and intimate. Trust, relatability, and continuity in our services are important for their growth stories and ultimately impact the region. The expected offering is bespoke, not necessarily from the “Harvard or LSE Business School” textbook.

What steps do you take to attract and retain top talent in the African markets, and how do you encourage professional growth and development within your organisation?

Our non-traditional approach, challenging the status quo and embracing diverse views, is a major attraction to our business. Most team members have had diverse global experiences and seek to provide a financial bridge to international practices and the product needs of the African consumer.

How do you address the increasing importance of digitalisation and technology in the metals & mining sector, and how does it influence The Critical Minerals Fund’s operations and partnerships experience?

The most exciting technology application in the last 12 months has been Kobold, a California mining exploration company that has announced that it will use AI to discover the biggest copper ore in Africa. We believe this technology will be a significant risk and cost mitigator for The Critical Minerals Fund, especially early-stage concessions that still have to get to resource definition.

We believe that with the application of the technology we are seeing in the mining sector today, with a combination of global best practices and local cultural insights, we will see more production. We want to see this new production through partnerships between the local concession-holders, custodians of the customary land, and the global experts/providers of capital in this sector. Some are sceptical, but we do not believe that the alternative of the Africans resides merely in handing over the land and concessions. This is unsustainable.

As a Founder and investor in companies, what is your overall vision and expectations for the future of the markets you operate in and how do you plan to achieve them?

The messaging from Pangaea Holdings is the same, irrespective of the sector we are investing in or advising. The notion that Africa is merely a source of raw materials, is no longer attainable. The continent has the youngest population in the world, is connected to the global village and comprises the most well-travelled generations. With the median age on the continent at only 18-20, this new generation of Africans want the same human experience that they witness on the internet and social media, the same interactions that their counterparts live on the other continents. For us, this is the vision and aspiration that we have a role to fulfil. It is transactional for individual clients and incorporates relatable cross-border impact into our communities. This vision is already in motion as we work with corporates and entrepreneurs who share our passion and believe in the transformation story and the pivotal role that Africa has to play in the 4th industrial revolution.

What advice would you give aspiring leaders or individuals seeking to join these industries?

One of the most shocking statistics we consistently encounter is that Africa provides the world with all the critical minerals. Still, it only attracts less than 5% of the capital earmarked for exploration. Our mission is to guide providers of capital and corporate leaders in identifying the right type of partners on the ground. At the same time, the noose on some of the conditionalities for investing should be loosened. For example, we are all aligned on the energy transition and the implementation of ESG fundamentals. However, we note that the West is obsessed with the “E” whilst the “G” is a given, and the “S” is viewed as a ‘negative’ related to child labour and human rights. However, our philosophy is to focus on the positives, such as uplifting the communities, working with the marginalised, properly transferring skills, value addition and benefaction (beneficiation???). For us, this is relatable as opposed to not solely focusing on “child labour” and “what is best for your ideologies”

This is not the default modus operandi for a mine in Africa. The International Monetary Fund (“IMF”) estimates that Africa can generate USD 2.0 trillion for mining due to the Transition. However, unless Africans lead in the participation in this transformation, it will be extremely difficult to move away from the “pit-to-port” model that currently exists. There is scope to develop a much broader ecosystem that encompasses (i) the geophysics, (ii) the transfer of skills, (iii) the development of new towns/cities through, (iv) industrialisation, (v) expansion of logistics infrastructure, (vi) value addition and beneficiation for intra-Africa trade, and (vii) more African mine-owners. We are hopeful that this is doable on the well documented terms of mutual benefit to all stakeholders.