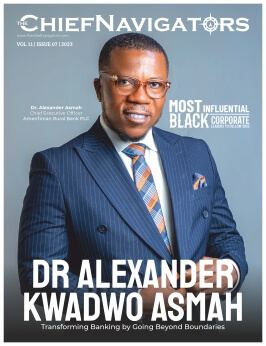

Dr Alexander Kwadwo Asmah: Transforming Banking by Going Beyond Boundaries

Most Influential Black Corporate Leaders to Follow 2023

With a Doctor of Business Administration from the esteemed California Intercontinental University, specializing in Leadership and Global Business, Dr Alexander Kwadwo Asmah‘s journey is a testament to his inexorable pursuit of knowledge. His academic odyssey also boasts an MBA in Banking and Finance and a Bachelor of Commerce degree, forming the bedrock of his profound understanding of financial intricacies.

The mantle of distinction further extends as Dr. Asmah proudly carries certificates from two of the world’s most prestigious business institutions. His Strategy certificate from Harvard Business School and Innovation Management certificate from IESE Business School in New York underscore his commitment to mastering the dynamic facets of business innovation and strategy.

A seasoned banker par excellence, Dr. Asmah’s career spanning over two decades paints a portrait of unwavering dedication and unparalleled achievements. His ascent through the ranks has been marked by successive triumphs, including pivotal roles as Operations Manager, Human Resource Manager, Finance Manager, and ultimately, Chief Executive Officer.

Currently at the helm of a burgeoning financial institution, Dr. Asmah orchestrates a team of 552 employees, a testament to his leadership acumen. Under his stewardship, the bank has flourished, attaining milestones that have redefined industry benchmarks. Notably, the institution has dominated the landscape in terms of total assets and profitability, setting a standard that competitors aspire to replicate.

Dr. Asmah’s global vision and expertise were honed during his tenure with Barclays Bank Ghana, where he gained invaluable international exposure in the intricate realm of finance. His membership in the Institute of Directors and the Chartered Institute Credit Management Ghana further underscores his commitment to professional excellence and continuous growth.

Supporting Local Economies

Amenfiman Rural Bank Plc was founded in 1980 by the indigenous people of Wasa Amenfi during the most difficult part of the community’s history when the change of the country’s currency resulted in significant losses to the people because of a lack of banking and saving services in the community. The paramount chief of Wasa Amenfi convened an operational team with the objective of collectively endeavouring to establish the Bank. Thereafter, Amenfiman Bank has undergone substantial growth, transitioning from a modest community-based institution into the premier entity within the expansive rural banking sector, encompassing a total of 146 rural and community banks.

Being driven by the vision to become Ghana’s Most Preferred Bank for the Micro, Small and Medium Enterprises sector, the Bank’s Mission has been to deliver first-rate financial services using the best people and technology to create the ultimate customer experience and value for stakeholders by enabling women empowerment and rural digital innovation.

Evolutionary Path in Banking

Dr. Asmah embarked on his banking journey as a management trainee within a Bank, where he was singled out as a standout talent earmarked for advancement to middle-level management roles in 2002. Progressing steadily via the corporate ladder, he undertook roles such as Operations Manager, Finance Manager, and Human Resource and Administration Manager, spanning a duration of six years. His managerial acumen was further enriched by his tenure at Barclays Bank, where he honed global financial competencies.

The exposure garnered from these various positions served as a catalyst for Dr. Asmah’s aspiration to delve deeper into leadership. Despite the abundance of leaders globally, a prevailing pattern of dissatisfaction and censure directed at leadership across multiple sectors propelled him to contemplate the need for more profound and transformative leadership. This insight kindled a resolute need within him to prepare for leadership roles that could instigate progressive impact. In this pursuit, he undertook a series of educational endeavors, including pursuing an MBA in Banking and Finance and a DBA in Leadership and Global Business, meticulously sculpting his capabilities for the industry.

Accumulating an array of invaluable soft skills over the course of his career, Dr. Asmah has reached significant milestones. Over the span of the last 16 years, he has been deeply embedded in executive management, with a remarkable 12 years spent as a Chief Executive. His guiding force throughout this journey has been his steadfast determination to champion the transformative shifts he envisions for the organization.

A Decade of Transformation

Dr. Asmah’s crowning achievement resides in the comprehensive and disruptive changes implemented during his tenure as the Bank’s leader, yielding remarkable value for the Bank’s stakeholders. Under his leadership, the Bank has undergone a remarkable metamorphosis: total assets have surged by a staggering 41-fold, the deposit portfolio has experienced an exponential increase of 4100%, and earnings have soared by an impressive 4800% over the twelve-year span in which he held the position of Chief Executive.

During this same period, Amenfiman Bank outperformed the industry across all key performance indicators (KPIs), boasting growth rates ranging from 200% to an impressive 330%. This collective success elevated the Bank to an unrivaled position as the industry’s premier entity. It’s important to note that prior to this transformative phase, Amenfiman Bank had grappled with a distressed status, wrestling through the majority of its initial three decades of existence. It is unequivocal that the most stable and prosperous chapter in the Bank’s history has been the culmination of the past twelve years, which transpired under Dr. Asmah’s astute leadership.

Elevating Excellence

Recognizing the paramount role of customers in the service business realm, Dr. Asmah comprehends that the very essence of the Bank’s existence hinges upon delivering satisfying experiences to customers. Central to Amenfiman’s ethos is the conviction that the customer occupies a position of paramount importance, thereby forming the bedrock upon which the entire business philosophy and strategy are structured. A pivotal touchstone is the principle that the customer holds the status of a king.

This ideology extends its roots to the heart of the Bank—its employees, entrusted as authorized agents vested with the responsibility of fostering customer contentment. Dr. Asmah firmly believes that ensuring the well-being of employees, the frontline caretakers of customers is a foundational imperative. By nurturing the well-being of these internal customers, and the employees, the Bank establishes a robust foundation for delivering exceptional care to external customers. This commitment manifests through continuous training and developmental initiatives, equipping employees to adeptly navigate customer challenges and devise solutions that not only fulfill but exceed customer expectations. Each of the bank’s offerings is meticulously crafted to meet individual needs, a testament to Dr. Asmah’s commitment to customer-centric innovation. The bank invests greater portions of annual profits into research and development, technology, and continuous improvements. Its service-excellent team works around the clock to ensure that service failures are addressed quickly. Dr. Asmah says, “It is with such dedication that affords Amenfiman’s its prime position in the industry.”

At Amenfiman, “We make money by serving. We recognize the individual needs of our customers and insulate them with a suite of optimized services. People are golden and they will pay for your efforts if you focus on serving them what they need and want with respect”. “Creating a winning business model around economically marginalized individuals is not an easy task. However, regarding their socioeconomic situations and consistently empowering their lives is the most rewarding business”.

Striking the Balance

Risk assessment and mitigation are critical characteristics of the success of the banking business. Here is the bank’s approach to risk management:

Amenfiman team begins with risk identification which involves a comprehensive assessment of the potential threats that could impact the bank’s operations and financial stability. This strategic approach empowers Amenfiman to meticulously examine its operational risk stemming from internal workflows, technological infrastructures, and human factors. With its core business centered on lending, the bank diligently appraises credit risk. Additionally, thorough evaluations of liquidity risk are conducted, ensuring the bank’s capability to fulfil financial commitments in both immediate and extended horizons. Moreover, Amenfiman adeptly scrutinizes market dynamics and adroitly mitigates reputation risk by identifying potential threats to its image triggered by adverse publicity or customer dissatisfaction.

Amenfiman analyses the risks identified to predict the probability and potential impact of each risk category. The team then formulates comprehensive risk mitigation strategies aimed at effectively handling these identified risks. These strategies encompass a spectrum of approaches including risk avoidance, risk transfer (often through insurance mechanisms), risk reduction through proactive measures, or the calculated acceptance of certain risks, supplemented by well-defined contingency plans. The bank’s diligence doesn’t end there; rather, it involves ongoing monitoring and continuous plan updates in response to evolving data and the emergence of novel risk factors.

Balancing risk-taking with innovation is essential for driving growth and progress in the banking business. The ability of Amenfiman’s employees to strike the right balance between risk-taking and innovation requires a thorough approach, aligning the organization’s objectives with the willingness to explore new opportunities while safeguarding against potential shortcomings. The following explains how the team has shaped a culture that encourages innovation

- Risk Culture: Amenfiman has developed and nurtured a strong risk culture among its employees to achieve long-term success and sustainability of the bank. Here, the organization’s culture encourages employees to take calculated risks and view failure as a learning opportunity.

- Test and Pilot Ideas: The bank encourages rapid piloting and experimentation with new ideas and strategies. Key to the bank’s implementation plans, new ideas always go through small-scale test/pilot implementations to assess potential risks and benefits before full-scale implementation.

- Risk Appetite: The organization’s risk appetite has been defined in policy, considering factors like industry dynamics, financial position, and stakeholder expectations.

- Scenario Planning: Hypothetical exercises are conducted to anticipate various outcomes and responses to potential risks, enabling proactive decision-making.

- Continuous Learning: Regularly review and learn from past risk-taking experiences and innovation efforts to improve future decision-making.

- Amenfiman also has a culture that recognizes and rewards individuals or teams to think creatively and push the boundaries of what is possible. It creates a sense of competition which drives people to come up with innovative solutions that stand out without the fear of failure.

Triumphs in Times of Crisis

Dr. Asmah encountered two profound challenges that embodied the challenges and consequence of his twelve-year tenure as Chief Executive.

The first pivotal moment occurred on his inaugural day as CEO. The Bank was entrenched in a state of distress, compounded by the turmoil of experiencing four CEOs and an Interim Management Committee (IMC) within the preceding six years. This tumultuous leadership turnover had left both the internal and external environment inhospitable to progress. Just prior to Dr. Asmah’s ascension, the three-member IMC resigned, leaving a management vacuum. Existing systems were inadequately established, further magnifying the complexities. To add to the predicament, employees were on the brink of a strike due to unfavorable working conditions, having rejected the proposed conditions. Dr. Asmah’s entrance as CEO unfolded in this turbulent backdrop, marked by the need to stabilize operations and address labor unrest.

The second substantial challenge emerged in the year 2020, in the throes of the global COVID-19 pandemic. Mere months before, Ghana’s banking sector had weathered the storm of multiple bank failures, resulting in diminished public trust. As the sector sought to regain stability, the pandemic struck, inflicting widespread economic hardship. This particularly impacted the Bank’s customer base, primarily situated at the economic bottom rungs. With vaccines unavailable in Africa, survival overshadowed loan repayment for many, eroding the predictability of financial outcomes. In response, the Bank shifted its perspective, considering the preservation of lives as paramount. Instead of solely pursuing profits, the Bank directed resources toward combating COVID-19, collaborating closely with local health authorities to mitigate the pandemic’s impact. This period underscored the Bank’s commitment to its social responsibilities in the face of immense adversity.

Vision through Ongoing Learning and Development

Sustained growth and ongoing learning have been instrumental in Dr. Asmah’s ability to remain attuned to evolving industry trends. A considerable allocation from the annual expenditure budget is earmarked for staff development and training. Emphasizing the importance of nurturing talent from within, the Bank has made substantial investments in staff development to ensure a seamless succession plan across all hierarchical levels. A pivotal advancement in this pursuit has been the implementation of an e-campus platform, which empowers employees to engage in self-driven learning and self-assessment.

On a personal level, Dr. Asmah has embraced a hybrid approach to learning, melding online educational programs with virtual learning platforms. This amalgamation ensures that he is consistently abreast of the latest trends shaping the industry. By intertwining these various educational channels, he has fortified his capacity to adapt to the dynamic shifts within the banking sector.

Embracing I.C.R.E.A.T.E

The Bank’s fundamental principles are encapsulated in the acronym I.C.R.E.A.T.E, embodying the following core values:

- Integrity: Upholding unwavering honesty and ethical conduct in all actions and decisions.

- Commitment: Demonstrating dedicated and steadfast devotion to the Bank’s mission and goals.

- Respect: Nurturing an environment of esteem and consideration for all individuals and perspectives.

- Equity: Ensuring fairness and impartiality, irrespective of background or circumstances.

- Ambitious: Fostering a culture of aspiring for greatness and striving for continual improvement.

- Teamwork: Embracing collaboration and synergy to achieve collective success.

- Excellence: Pursuing the highest standards of quality and consistently delivering exceptional outcomes.

Empowering Through People-Centric Leadership

Dr. Asmah’s leadership philosophy centers on being a people-centric leader, attributing his accomplishments to the collective efforts of his team. He fervently believes in achieving results through the empowerment and motivation of his team members. His leadership style hinges on fostering a spirited and engaged team through a sophisticated communication strategy.

Dr. Asmah artfully employs an array of people-oriented techniques, notably empathy, and enthusiasm, which form the bedrock of his ability to cultivate strong bonds and establish trust within his team. His dedication extends to ensuring that his employees are not only empowered but also share a deep loyalty to the company’s overarching vision.

He also acknowledges the contextual nature of leadership, adeptly wielding diverse leadership styles as warranted by the situation at hand. Frequently assuming the mantle of a charismatic figure, Dr. Asmah becomes the catalyst for inspiration and the force behind empowerment, and propelling positive impact. Nevertheless, his strong commitment to a people-centered philosophy frequently necessitates the adoption of an adaptive leadership posture. Within this framework, Dr. Asmah steers with empathy, creating a space for inclusion and individual welfare. Dr. Asmah’s commitment, firmly rooted in achieving customer satisfaction serves as a North Star in steering Amenfiman Rural Bank Plc. and its clients toward a progressive future today.

Please Visit: https://amenfimanbank.com/