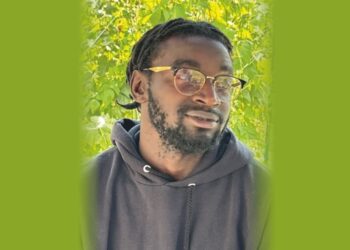

George Evans, the Chief Revenue Officer, President, and Co-Founder at Convergence Inc, is a seasoned entrepreneurial business leader with a successful track record in developing growth and product strategies. He places a strong emphasis on transparency and open communication in his leadership approach. Over his 40-year career, George has focused on various aspects of the business, including data analytics, business development, client management, sales, product development, operations, and technology consulting. His expertise extends to areas such as strategic project management, asset management transaction advisory, and financial services executive search.

George has a wealth of experience in achieving consistent and sustainable revenue and EBITDA growth. His work has often involved change management and re-engineering in the asset management sector, covering front, middle, and back office operations. He has successfully implemented future state operating models, prioritizing factors like profitability, scalability, world-class technology, and effective data utilization, as well as fostering partnerships and outsourcing models.

Currently, George primarily collaborates with various entities, including alternative fund managers, asset managers, financial technology firms, custodians, prime brokers, fund administrators, audit firms, law firms, compliance firms, pension and endowment funds, private equity firms, large consultants, and Fortune 1000 companies.

Below are highlights of the interview:

In your role as CRO, you mention leading with transparency and open communication. How do you prioritize these principles in your leadership approach, and what benefits have you observed from doing so?

The vision of the firm is shared with all colleagues; expectations and goals are very clear. I have learned in my senior sales role that the buck stops with you; there is no gray; it is very black and white.

Data analytics is a significant part of your background. How have you seen the role of data analytics evolve over your career, and what are some key trends or opportunities in this field?

The key to our success has been to structure and enrich the data. Our data science teams create original content starting with public-domain data. That second, third, and fourth derivative data creates analytics not seen in the industry before (i.e., risk rating for alternative asset managers). We inject color and insight into the data for the end client.

Business development is another key focus of your career. Could you share insights into your approach to identifying and seizing business development opportunities, especially in the context of data analytics and technology?

It is all about proper targeting of the market and solving a prospect issue. We take a ‘best fit’ approach. Very metric-based: x number of meetings leads to y number of proposals and z number of wins. Active pipeline management has been the key to our success.

You’ve been involved in change management and the re-engineering of asset management operations. What are some common challenges you’ve encountered in these areas, and how have you successfully navigated them?

The first is a culture of change. Next, the potential growth trajectory will fuel that change. Lastly, is there an opportunity to upgrade the technology stack, upgrade staff, and ultimately create operational alpha?

You’ve been involved in asset management transaction advisory and financial services executive search. What key qualities or skills do you believe are crucial for professionals in these domains?

Succession planning is key on the asset management front. Qualities that are critical include business ethics, work ethic, market knowledge, and teamwork.

From your perspective, what do you see as the most significant opportunities and challenges in terms of leveraging data, technology, and outsourcing models for business growth and profitability in the future?

Data is power; it can set the right course for your business—where to spend time in the market, and what you learn from and act upon from the analytics. AI will redefine many businesses. Finding the right balance between what to do internally and what to outsource is an art, not a science.

Website: Convergence Inc