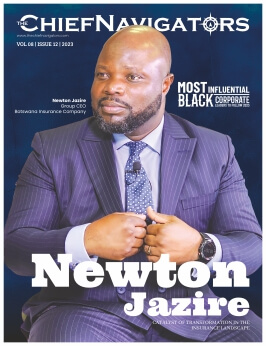

Newton Jazire: Catalyst Of Transformation In The Insurance Landscape

Most Influential Black Corporate Leaders to Follow 2023

In the bustling heart of Botswana’s financial landscape, a beacon of leadership stands tall, steering the course of the insurance sector towards uncharted heights. Meet Newton Jazire, the driving force behind Botswana Insurance Company (BIC), a visionary leader whose influence resonates not only within the confines of his own company but ripples across the entire industry. With an unparalleled network and an unyielding commitment to progress, Newton has assumed a role that transcends mere executive responsibilities, embracing a mission to elevate an entire nation.

Newton’s journey is one deeply intertwined with the insurance domain, a sector that he has not only shaped but also wholeheartedly embraced. Across diverse international landscapes, he has donned numerous leadership mantles, leveraging his extensive experience to enact transformative change. It was his distinguished track record that beckoned him to the helm of Botswana Insurance Company, a challenge that he accepted with an unwavering resolve.

The corridors of BIC witnessed a seismic shift under Jazire’s leadership. In response to the shareholders’ call for rejuvenation, he embarked on a mission to recalibrate not just the company’s performance metrics but its very cultural fabric. Newton asserts, “My inspiration is based on my ability to transform an organisation into a strong and robust asset to its shareholders, while giving its staff members an amazing work / life opportunity to grow and exel.”

Pioneering Excellence

BIC is driven by a mission to consistently exceed the expectations of their esteemed clientele, thus striving to enhance the quality of life. The Diamond Arrow award for Best General Insurer in Botswana, bestowed by PMR and determined through surveys of both corporate entities and individuals, has been conferred upon BIC. An exceptional accolade, this award highlights BIC’s standing in the industry.

Distinguished as the solitary domestic insurer possessing an international credit rating of Baa2 from Moody’s, BIC boasts a comprehensive array of Commercial, Personal, and Specialist Insurance Covers. Notably, BIC retains full control over underwriting and claims authorization within Botswana’s borders, obviating the necessity of external consultation for risk assessment or claims approval.

Setting itself apart, BIC stands as the exclusive local insurance provider furnished with an all-encompassing multi-channel distribution network. This strategic framework empowers customers to elect their preferred mode of engagement with BIC, aligning with their individual preferences and needs.

Aligning Personal and Organizational Aspirations

Aligned with its vision of becoming the preferred insurer in its operational markets, BIC envisions itself as the primary choice for insurance services. This vision serves as a crucial point of alignment as efforts are directed towards personal vision creation. The individual’s vision takes the form of being the foremost leader of choice. Achieving this involves achieving excellent commercial and climate-related outcomes. Through such achievements, the individual aims to secure their position as the favored leader among shareholders, employees, and customers.

To realize this personal vision, a commitment to embracing international leadership “Best Practices” is paramount. The pursuit of continuous learning stands as a core value, not only for the individual but also for their team. This approach ensures that growth and advancement remain constant, facilitating the journey toward becoming the Leader of First Choice.

Path to Sustained Growth

With unwavering dedication, Newton places a primary emphasis on several key areas: Distribution, Customer Experience, Operational Effectiveness & Efficiencies, Digital Transformation, and the cultivation of strong and resilient relationships with all stakeholders. These areas collectively constitute the bedrock of Newton’s strategic focus.

Furthermore, Newton consistently seeks out and onboards exceptional talent, infusing fresh perspectives and innovative thinking into the organization. A noteworthy instance of this commitment transpired in 2022 when Newton appointed a Chief Product and Innovation Officer. This strategic move was designed to allocate resources specifically to foster, champion, and execute groundbreaking ideas within the organization. Through such deliberate efforts, Newton positions itself at the forefront of innovation and progress, effectively positioning itself for sustained growth and success.

Adaptive Response to the COVID-19 Challenge

Amidst the challenges posed by the COVID-19 pandemic, Newton assumed a proactive leadership role in guiding both the organization and its customers through the economic downturn. BIC, under Newton’s guidance, took decisive steps to address the situation. Notably, the company introduced reduced premiums for customers, ensuring continued affordability during these uncertain times. Additionally, BIC provided a commitment to brokers by guaranteeing commissions, thereby offering stability and support to key partners.

Internal reassurance was also a priority, as Newton and the leadership team ensured that staff members were given assurance about the security of their jobs and income. This approach fostered a sense of confidence and unity within the organization, even in the face of challenging circumstances. As a result of these concerted efforts, BIC experienced notable growth in both market share and profitability.

Elevating Customer Experiences

Under Newton’s leadership, BIC successfully introduced a cutting-edge digital tool for enhancing customer experiences, named “A re Bue.” This innovative platform allows

customers to not only rate the quality of our services but also log any concerns or complaints they may have. The efficiency of this system is notable, as it directly channels complaints to Newton and the corresponding operations team lead, ensuring swift and effective resolutions.

To measure the caliber of customer service, BIC employs a monthly Net Promoter Score (NPS) assessment, which provides valuable insights into customer satisfaction and loyalty, driving continuous enhancements. Recognizing the commitment to exceptional service, BIC has earned various esteemed customer service awards, including:

- PMR Diamond Arrow Award – Recognized as the Best General Insurer for consecutive years in 2021, 2022, and 2023.

- Chartered Institute of Customer Management Industry Winner – Acknowledged as the Top Performing General Insurer for both 2021 and 2022.

- Global Banking and Finance Award – Conferred as the Best General Insurer for three consecutive years in 2021, 2022, and 2023.

Building a Dynamic Workforce

BIC places significant emphasis on establishing a recruitment and selection process that meticulously identifies and brings aboard high-achieving individuals who resonate with the company’s mission and values. A robust Employee Value Proposition (EVP) is also offered, underscoring the allure of the brand as a desirable workplace. Moreover, as a frontrunner in the industry, BIC stands as an aspirational destination for professionals seeking to be a part of a thriving success narrative.

Under Newton’s leadership, internal promotion is prioritized, rooted in performance as a primary criterion, before seeking external candidates to fill positions. The company’s commitment to employee growth is evident in its comprehensive training initiatives, which encompass diverse facets ranging from formal qualifications to internal training programs. This holistic approach to development ensures that BIC’s workforce remains well-rounded and capable, fostering a culture of continuous improvement and skill enhancement.

Transformative Technological Offerings

Digital transformation is a key enabler of customer satisfaction. In this respect BIC developed and implemented the following technologies:

- “A re Bue” Customer Service and Complaints Tracker

- My BIC – the first Customer Self Service Portal in the local Insurance Industry

- Intermediary Portals – Brokers, Banks and Agents can service their customers remotely using the Intermediary Portal

- WhatsApp for Biusiness – Nkamo was introduced to allow our mobile customers to interact with BIC using WhatsApp

- Claims Automation – a combination of Digital Pdf forms and AI Bots speeds up the time it takes to submit a claim and the time it takes to resolution.

- Improved Website Functionality for customers

- Social Media functionality using Facebook Business Suite

Unwavering Commitment to Values

BIC upholds its values with unwavering commitment, viewing them as non-negotiable principles that guide its actions. The company adheres to the utmost standards of ethics and integrity in all endeavors. BIC’s Corporate Social Investment (CSI) initiatives are prominently centered around two pivotal areas: Sports and Education. Through these initiatives, the company demonstrates its dedication to making meaningful contributions to these realms, thereby creating a positive impact within the broader community.

Guiding Principles for Success

Newton’s counsel to aspiring leaders or individuals aspiring to join the insurance sector is rooted in the recognition that this industry offers substantial potential for a rewarding career trajectory. However, the realization of this potential hinges significantly on one’s personal attitude and approach. To excel as a top performer and a valuable contributor to both the company and its shareholders, embracing a proactive and dedicated mindset is paramount.

“The insurance sector can offer ample opportunities, but success ultimately depends on your commitment to excellence and your determination to positively impact the company’s growth and stakeholder value.”

Website: https://www.bic.co.bw/