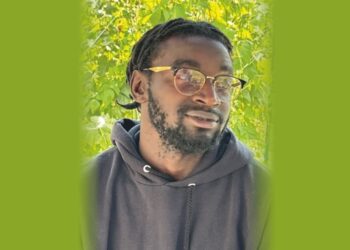

Ryan Victor, the Chief Revenue Officer at Finxact, leverages over 15 years of experience in the financial services industry. His career began as a sales leader, specializing in selling full-service financial products for boutique investment firms in New York City. Prior to his role at Finxact, Mr. Victor gained experience working with technology providers like Apple Inc. (NASDAQ: AAPL), where he managed a business development team; Hewlett-Packard Enterprise (NYSE: HPE) as an FSI Senior Account Manager; Finastra as a Strategic Account Manager; and Mambu as the North America Sales Lead. With a diverse background in both the financial services and fintech sectors, he brings a unique perspective and skill set to serve Finxact’s clients.

Below are highlights of the interview:

You started your career selling full-service financial products for boutique investment firms in NYC. Can you share some key lessons you learned during this early phase of your career that have been valuable throughout your journey in the financial services industry?

Time management, focus, and attention to detail trust and integrity: in a number-driven industry, short- and long-term success hinges on relationships grounded in trust; Adaptability: The financial landscape (like FinTech) constantly evolves, and we must learn to pivot and dig in. Continuous learning: stay student-like and observe and understand as much as you can to keep up and gain the edge while navigating the complexities of day-to-day information intake.

How did you transition from selling financial products to leadership roles in the industry, ultimately becoming the Chief Revenue Officer at Finxact?

Competitive Drive: – began as a highly competitive individual contributor, fuelled by a background as a college athlete and a will to win. Mentorship and Team Building: Being part of a team much of my life and having various coaching and business mentors in the organizations I was part of, I leveraged these experiences for the art of building teams, managing through others, and establishing key KPIs that aligned to team and organizational success. The most recent mentor, Michael Sanchez, has been key in recent years. Corporate and start-up experience and leadership: working with various leaders from companies like Apple, HP, and Finastra, I took what I thought were the best attributes and molded them together to be the best. Strategic Vision: In a dynamic market, I drive specific outcomes in an evolving market. Adapting to the market with a strategic approach is key.

What strategies or approaches have you found most effective in building successful sales teams and increasing revenue in the financial services sector?

I like to know each member of the team personally and professionally. What motivates them—strengths, weaknesses, or goals? Each member plays a key and unique role, and we all pick each other up and help coach. Drawing from each member’s background, we are all better for it, which allows me to continually learn as well. The better you know the market, the more successful you can be in attracting talent that understands how to achieve success in a dynamic sector.

What are some of the unique challenges and opportunities you’ve encountered in leadership positions within the financial services industry, and how do you navigate them?

The technology landscape has changed every year, and how you sell this technology must evolve almost weekly. There are new challenges buyers are trying to solve daily. Competition is stiff, and staying ahead of both market challenges and competition is vital for success. We feel like we have the best cloud-based banking platform in the industry, and we need to tell this story every day in multiple ways. Some other challenges would be: Evolving financial and tech industries, team dynamics, and managing across all geographies, all segments, and all internal business units

The financial services industry is constantly evolving. Can you share your insights into current trends and innovations that are shaping the industry, especially in areas like fintech and digital banking?

Banking and fintech change each day, and the intersection is constant. The competitive landscape, not just for Finxact but for our partners, is evolving every minute. Trust in the marketplace is key. We see banks looking to partner with Fintech every day for time to market, tech modernization, reduction of overall expenses, recruiting, and driving revenue and services without geographical boundaries.

How does Finxact stay ahead of the curve in adopting and integrating emerging technologies to provide cutting-edge solutions to clients?

Finxact really created the category of “next generation core banking” or ‘next generation innovation platform” and has the most live and signed customers in the US, with live use cases across all segments of the industry. This is due to our approach as an open platform built by legends and long-time SME’s in the field. We know what it takes and move the needle forward each day with each key deliverable. The team at Finxact is the best in the field. Our platform is perfect for LFIs, fintechs, and community banks of all sizes. It is always on and will move as fast or faster than your business to be able to accommodate all your wildest ideas. Not only are we pulling in the best of what the market has to offer in terms of technology integrations in our platform via APIs, but also people. As a Fiserv brand, we have the best of both worlds and can offer this to the marketplace.

Throughout your career, what personal and professional growth experiences have had the most significant impact on your leadership style and approach to the financial services industry?

Being a competitive person through sports and adapting to multiple teams and leaders, I have been able to use this in the business world. I have been very fortunate to be around market-leading executives like Frank and Michael Sanchez and now the Fiserv executive team. These are truly moving experiences and the best learning experiences one can have. Just as I was motivated to be the best player on the field, I am equally motivated to be the best I can as a person and businessperson with the best team we have in the market.

Looking ahead, what trends or developments do you anticipate in the financial services industry, and how does Finxact plan to adapt and thrive in this evolving landscape?

BaaS, embedded finance, and digital banks are separate from traditional banks and operate separately.

Website: Finxact