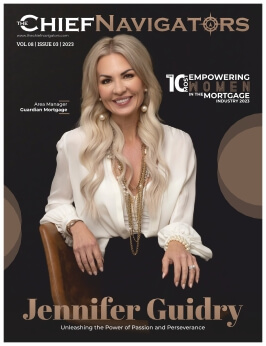

Jennifer Guidry: Unleashing the Power of Passion and Perseverance

The 10 Most Empowering Women in the Mortgage Industry, 2023

In the realm of mortgage services, where dedication, innovation, and a genuine commitment to clients reign supreme, one name stands out: Jennifer Guidry, the Area Manager at Guardian Mortgage. With an unwavering work ethic, a penchant for thinking outside the box, and an unparalleled dedication to service, Jennifer has solidified her position as the epitome of excellence. Her remarkable ability to put others at ease, coupled with her innate desire to assist, has garnered her numerous accolades, including the prestigious title of San Antonio’s No.1 Loan Officer for an impressive four consecutive years.

Jennifer’s outstanding achievements extend far beyond local recognition. In a field comprising over 500,000 professionals nationwide, she has earned her place among the industry’s elite.

Last year, she achieved a ranking of #38 among women and secured a position within the Top 175 nationwide.

Graciously acknowledging the contributions of her exceptional team, trusted realtors, and visionary custom home builders, Jennifer attributes her triumphs to the unwavering support of those around her. Endlessly grateful for the loyal patronage and the referrals from her satisfied clients, she humbly acknowledges their role in shaping her success.

Specializing in a diverse range of loan types, including VA, Construction, VA Construction, Conventional, Portfolio Jumbo, and FHA loans, Jennifer’s expertise transcends boundaries. With an impeccable track record spanning nearly three decades, she exudes a level of mastery and finesse that is unmatched in the industry.

Jennifer’s journey into the realm of mortgages began at the tender age of 19 when she joined a Southern California mortgage company as a receptionist. Swiftly discovering her true calling, she boldly chose to diverge from her path of studying to become a doctor and wholeheartedly embraced the world of loans. Today, after almost three decades of unwavering dedication, Jennifer finds herself at the pinnacle of her career.

In selecting the ideal company to nurture her professional growth, Jennifer’s discerning eye led her to Guardian Mortgage. Recognizing that it offered the perfect blend of resources, support, and opportunities, she eagerly embraced the chance to join this remarkable organization. Thrilled to be a part of a team that shares her passion and values, Jennifer’s fervor for her work is unrivaled.

While many might not have envisioned a childhood dream of becoming a loan officer, Jennifer firmly believes that the industry holds immense potential and should be celebrated as a worthy aspiration. With her unyielding determination and unwavering commitment to service, she has shattered boundaries and carved a path of excellence that continues to inspire all those fortunate enough to cross her path.

Driving Success through Leadership

As a VP/area manager in the mortgage industry, Jennifer’s primary responsibilities revolve around overseeing her branch and team, ensuring that Guardian Mortgage achieves or surpasses its sales and operational targets, and delivering exceptional customer service to clients.

Jennifer places a strong emphasis on communication and collaboration to ensure effective management and leadership within her area. She works closely with her team members, understanding their challenges and goals, and provides them with the necessary resources and support to succeed.

Jennifer believes in the importance of continuous training and professional development for her team. This approach ensures that team members stay updated on industry trends and regulations while also expanding their skills and advancing their careers.

Setting clear goals and expectations is another crucial aspect of Jennifer’s leadership approach. She holds her team accountable for meeting these targets, fostering a culture of ownership, accountability, and self-motivation. This approach leads to improved performance and better outcomes for clients.

Creating a positive and collaborative workplace culture is also a priority for Jennifer. She values and supports each team member, recognizes and rewards their hard work and dedication, and fosters a sense of camaraderie and mutual respect throughout the organization. Celebrating successes as a team further enhances the positive environment.

Navigating Challenges, Embracing Opportunities

Jennifer identifies the constantly changing regulatory environment as one of the major challenges in the mortgage industry. To comply with evolving regulations, lenders must remain diligent and ensure adherence to applicable laws and guidelines. Smaller lenders may face additional difficulties due to resource constraints compared to larger institutions.

Another challenge is the intensifying competition within the mortgage industry, leading to decreased margins and increased pressure on lenders to differentiate themselves. Staying ahead of competitors and enhancing the customer value proposition are vital to succeed in this competitive landscape.

Despite the challenges, Jennifer recognizes significant opportunities in the industry. Technological innovation presents a key opportunity for lenders to leverage new tools and data analysis, improving decision-making, automating manual tasks, and enhancing the overall customer experience.

Additionally, there is a growing demand for personalized service and guidance as diverse segments of the population enter the housing market. Lenders that can provide tailored solutions catering to the unique needs and goals of individual borrowers will be well-positioned for success.

To navigate these challenges and capitalize on opportunities, Jennifer emphasizes the importance of staying informed about industry trends, regulatory developments, and best practices. Leveraging a team of experts and diverse manufacturing channels can help make data-backed decisions that deliver results for both customers and lenders.

Strategic investment in data and analytics platforms, third-party solutions, and metrics-driven practices can enable more precise lending velocity, uncover new revenue opportunities, and contribute to higher margins and lower costs for organizations.

Providing Personalized Attention and Streamlined Processes

Guardian Mortgage, according to Jennifer, prioritizes a seamless and stress-free mortgage process for its clients. They take great care to offer personalized attention and guidance throughout the journey.

The process typically begins with an initial consultation, where the loan officers at Guardian Mortgage work closely with borrowers to understand their specific needs and goals. They provide a comprehensive overview of available loan products and services, along with the necessary documentation and application requirements.

Once a borrower has chosen a loan product and submitted their application, the team at Guardian Mortgage swiftly and efficiently processes the application, preparing all required disclosures and documents. Utilizing advanced technology and automation, they streamline the lending process, ensuring speed and efficiency.

Throughout the entire mortgage lending process, Guardian Mortgage maintains regular contact with the borrower. They provide timely updates and guidance, recognizing the potential complexity and overwhelming nature of the process. Guardian Mortgage is committed to offering personalized support to ensure a stress-free and enjoyable experience for their clients.

Delivering Personalized Mortgage Solutions

At Guardian Mortgage, the team strongly believes in understanding customers’ needs and goals, working closely with them throughout the entire mortgage process to provide a seamless and stress-free experience.

Guardian Mortgage stands out by offering a diverse range of loan products and services tailored to meet the specific requirements of each borrower. Whether it’s conventional, FHA, VA, jumbo, or construction loans, they strive to have options that suit individual needs.

The company’s commitment to utilizing cutting-edge technology is another competitive advantage. By leveraging innovative tools like artificial intelligence and machine learning, Guardian Mortgage automates crucial processes, enhancing the speed and efficiency of their lending services.

The team at Guardian Mortgage consists of industry-leading experts with extensive experience and expertise. This ensures that customers receive personalized guidance and support at every step of their mortgage journey.

Staying Ahead of the Mortgage Industry

Jennifer utilizes various resources and strategies to stay ahead of the curve in the mortgage industry. One key strategy is actively participating in industry conferences, networking events, webinars, and publications. These opportunities allow her to hear from industry experts, learn about innovative products and services, and connect with colleagues and peers.

Jennifer also subscribes to industry publications, including digital newsletters and print magazines, to stay informed about industry trends, regulatory changes, and best practices. She places importance on data-driven industry analysis, keeping abreast of market trends, industry analytics, and performance benchmarks. This helps inform sales and growth efforts, product design, underwriting enhancements, and pricing strategies.

Besides, Jennifer actively engages with other industry professionals through peer mentoring programs, industry groups, and online forums. Collaborating with peers and experts enables her to stay connected and foster innovative problem-solving.

Nurturing a Positive Work Culture

As a leader in the mortgage industry, Jennifer places great importance on fostering a positive and productive work culture within her team. Communication is a key principle she prioritizes, maintaining an open-door policy that encourages employees to approach her with any concerns or ideas they may have.

Collaboration is another vital aspect of Jennifer’s leadership approach. She actively encourages her team to work together, recognizing that collaboration can lead to greater achievements and contribute to a positive and productive work environment.

In addition, Jennifer emphasizes empathy and compassion in her leadership style. She understands that her team members may face challenges outside of work, and she strives to be a compassionate and understanding leader who supports their needs.

By prioritizing these values and principles, Jennifer believes that her team can thrive and perform at their best within the organization. A positive work culture built on effective communication, collaboration, and empathy enables her team members to feel supported, motivated, and engaged, ultimately leading to their professional growth and success.

The Path to Success in the Mortgage Industry

Jennifer believes that successful mortgage professionals possess a unique set of qualities and skills that enable them to excel in their field. Here are some of the key qualities she considers important:

- Strong work ethic: Mortgage professionals need to be hardworking and dedicated to their clients, managing multiple deadlines and priorities effectively.

- Attention to detail: Meticulous attention to detail is crucial for a successful mortgage professional to ensure accuracy and compliance throughout the loan process.

- Excellent communication skills: Effective communication with clients, industry professionals, and team members is essential for building strong relationships and ensuring clear understanding throughout the mortgage process.

- Adaptability and resilience: The mortgage industry is subject to constant change, so professionals must be adaptable and resilient in the face of challenges and evolving market conditions.

- In-depth knowledge and expertise: Successful mortgage professionals possess a deep understanding of industry regulations, financial instruments, and underwriting processes to provide the best service and guidance to clients.

To identify and develop talent within her team, Jennifer focuses on providing opportunities for professional growth and development. This includes regular training programs and mentorship opportunities to help team members enhance their skills and stay up-to-date with industry trends.

Additionally, Jennifer takes the time to understand each team member’s individual strengths, interests, and career goals. She works closely with them to identify opportunities for advancement and provides support throughout their career journey.

Embracing Technology and Customer-Centricity

One of the major emerging trends that Jennifer believes will have a significant impact on the mortgage industry is the increasing use of technology to streamline processes and enhance convenience for borrowers. There is a growing focus on enabling consumers to apply for mortgage loans and complete the application process online. This trend is expected to continue, with lenders investing in advanced technologies like blockchain to improve the efficiency and transparency of the underwriting process.

Another trend that Jennifer sees shaping the future of the industry is the growing importance of customer service and satisfaction. Lenders are realizing that the mortgage process can be overwhelming for borrowers and are striving to provide more personalized services that cater to individual needs. This may involve leveraging data and analytics to gain a deeper understanding of borrower preferences, or offering guidance and support throughout the mortgage process via mobile apps and other digital platforms.

While the current market conditions may present challenges, Jennifer emphasizes that the mortgage industry operates in cycles. She believes that the tough times will eventually pass, and the industry will experience periods of growth and opportunity. By staying adaptable, keeping an eye on emerging trends, and leveraging innovative solutions, mortgage professionals can position themselves for success in the long term.

Building Knowledge, Expertise, and Relationships

Jennifer advises individuals considering a career in the mortgage industry to focus on building a strong foundation of knowledge and expertise. Given the complexity and rapid evolution of the industry, it is essential to have a solid understanding of industry trends and regulations to thrive.

To achieve this, Jennifer suggests pursuing relevant education and training opportunities, such as courses in finance, real estate, and mortgage lending. Seeking mentorship from experienced professionals in the field can also provide valuable guidance and insights.

Networking plays a crucial role in the mortgage industry, so individuals should actively engage in opportunities to connect with peers and colleagues. This can involve attending industry events, joining professional organizations, and building relationships with real estate agents and other industry stakeholders.

Furthermore, individuals should prioritize strong communication and customer service skills as these are vital for establishing relationships with clients and closing deals successfully.

Guardian Mortgage, a division of Sunflower Bank, N.A. | NMLS# 709491 | Member FDIC